The 15-Second Trick For San Diego Home Insurance

Secure Your Comfort With Reliable Home Insurance Policy Plans

Why Home Insurance Is Important

The relevance of home insurance coverage depends on its capacity to offer financial protection and satisfaction to house owners in the face of unforeseen occasions. Home insurance offers as a safety and security web, providing protection for damages to the physical framework of your house, individual belongings, and responsibility for crashes that may happen on the residential or commercial property. In case of all-natural disasters such as fires, floodings, or quakes, having an extensive home insurance coverage policy can aid home owners recover and restore without facing substantial economic problems.

Moreover, home insurance policy is frequently required by mortgage lending institutions to shield their financial investment in the building. Lenders wish to make certain that their monetary passions are secured in situation of any damages to the home. By having a home insurance coverage plan in position, home owners can satisfy this need and safeguard their financial investment in the building.

Kinds Of Coverage Available

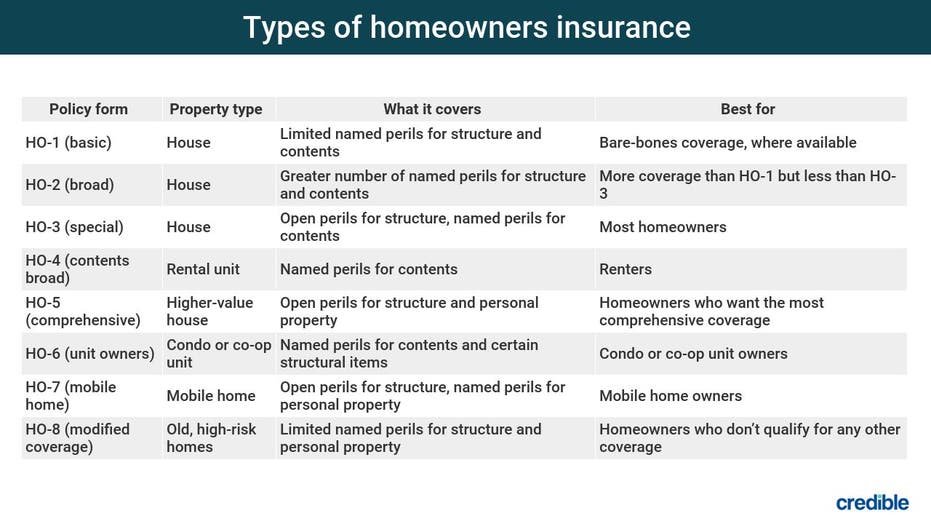

Provided the relevance of home insurance coverage in securing home owners from unexpected financial losses, it is important to comprehend the various kinds of coverage offered to tailor a plan that matches private requirements and situations. There are a number of key types of coverage provided by most home insurance policies. Individual residential or commercial property coverage, on the various other hand, safeguards valuables within the home, including furnishings, electronic devices, and apparel.

Elements That Effect Premiums

Variables influencing home insurance policy premiums can differ based on a series of considerations particular to private situations. One considerable aspect influencing premiums is the location of the insured home. Homes in areas prone to natural calamities such as earthquakes, storms, or wildfires normally attract greater costs as a result of the boosted danger of damage. The age and problem of the home also play a critical duty. Older homes or residential properties with out-of-date electrical, pipes, or heating systems might position greater risks for insurance provider, leading to greater premiums.

Additionally, the coverage limitations and deductibles selected by the policyholder can impact the premium quantity. Choosing for greater protection restrictions or lower deductibles typically causes higher costs. The sort of building and construction products made use of in the home, such as wood versus block, can additionally affect premiums as specific products may be much more susceptible to damage.

How to Pick the Right Policy

Picking the proper home insurance coverage plan includes careful factor to consider of various key aspects to make certain thorough coverage tailored to individual needs and situations. To begin, evaluate the value of your home and its contents properly. Understanding the replacement price of your dwelling and personal belongings will help figure out the coverage limits needed in the policy. Next, think about the different kinds of protection available, such as house protection, personal effects protection, responsibility defense, my blog and additional living expenses protection. Tailor these protections to match your details requirements and danger elements. In addition, assess the plan's exemptions, limitations, and deductibles to guarantee they align with your economic capabilities and take the chance of resistance.

Moreover, reviewing the insurance coverage company's reputation, financial security, client service, and asserts procedure is essential. By thoroughly evaluating these variables, you can pick a home insurance plan that supplies the necessary defense and peace of mind.

Advantages of Reliable Home Insurance Coverage

Dependable home insurance policy provides a feeling of security and defense for property owners versus unexpected occasions and financial losses. Among the essential advantages of dependable home insurance policy is the assurance that your building will be covered in the occasion of damages or destruction brought on by all-natural disasters such as fires, tornados, or floods. This protection can assist property owners stay clear of birthing the full cost of repair work or rebuilding, supplying assurance and financial stability during tough times.

Additionally, trusted home insurance policies typically consist of responsibility protection, which can safeguard property owners from lawful and clinical expenditures in the instance of accidents on their home. This protection expands past the physical framework of the home to shield versus legal actions and cases that might emerge from injuries sustained by site visitors.

Moreover, having dependable home insurance can also add to a feeling of total health, recognizing that your most substantial financial investment is secured against different risks. By paying regular costs, home owners can minimize the prospective monetary concern of unexpected occasions, permitting them to concentrate on enjoying their homes without constant bother with what may occur.

Final Thought

Finally, safeguarding a reliable home insurance coverage is important for protecting your building and items from unforeseen events. By comprehending the kinds of protection available, aspects that impact costs, and how to select the right plan, you can guarantee your assurance. Relying on in a trusted home insurance coverage company will see use you the advantages of monetary defense and protection for your most important property.

Navigating the world of home insurance policy can be complex, with different insurance coverage options, plan variables, and considerations to evaluate. Recognizing why home insurance is vital, the kinds of coverage offered, and just how to choose the right policy can be essential in guaranteeing your most significant investment stays safe and secure.Offered the importance of home insurance coverage in securing home owners from unanticipated financial losses, it is important to comprehend the different kinds of insurance coverage readily available to tailor a policy that suits private demands and conditions. San Diego Home Insurance. There are numerous key types of coverage provided by many home insurance coverage plans.Picking the suitable home insurance policy involves careful consideration of various key aspects to ensure comprehensive coverage customized to specific demands and scenarios